From transactional to always-on: Why advisors need a SaaS approach

Starting every new deal from scratch is limiting your growth. Advisors need to shift from a transactional to an always-on mindset to drive professional advantage.

By AnsaradaSun Oct 20 2019Advisors

Advisors are losing significant value and hours of resources by taking a transactional approach to serving clients, with existing due diligence information and structures being used effectively just the once.

While this legacy approach might have been effective when businesses operated and technology adopted at a much slower pace, it no longer has a place in an age where a subscription model can offer much greater flexibility and value.

Research from IDC shows SaaS delivery will significantly outpace traditional software product delivery, growing nearly five times faster than the traditional software market. This year, the cloud software model will account for $1 of every $4.59 spent on software.

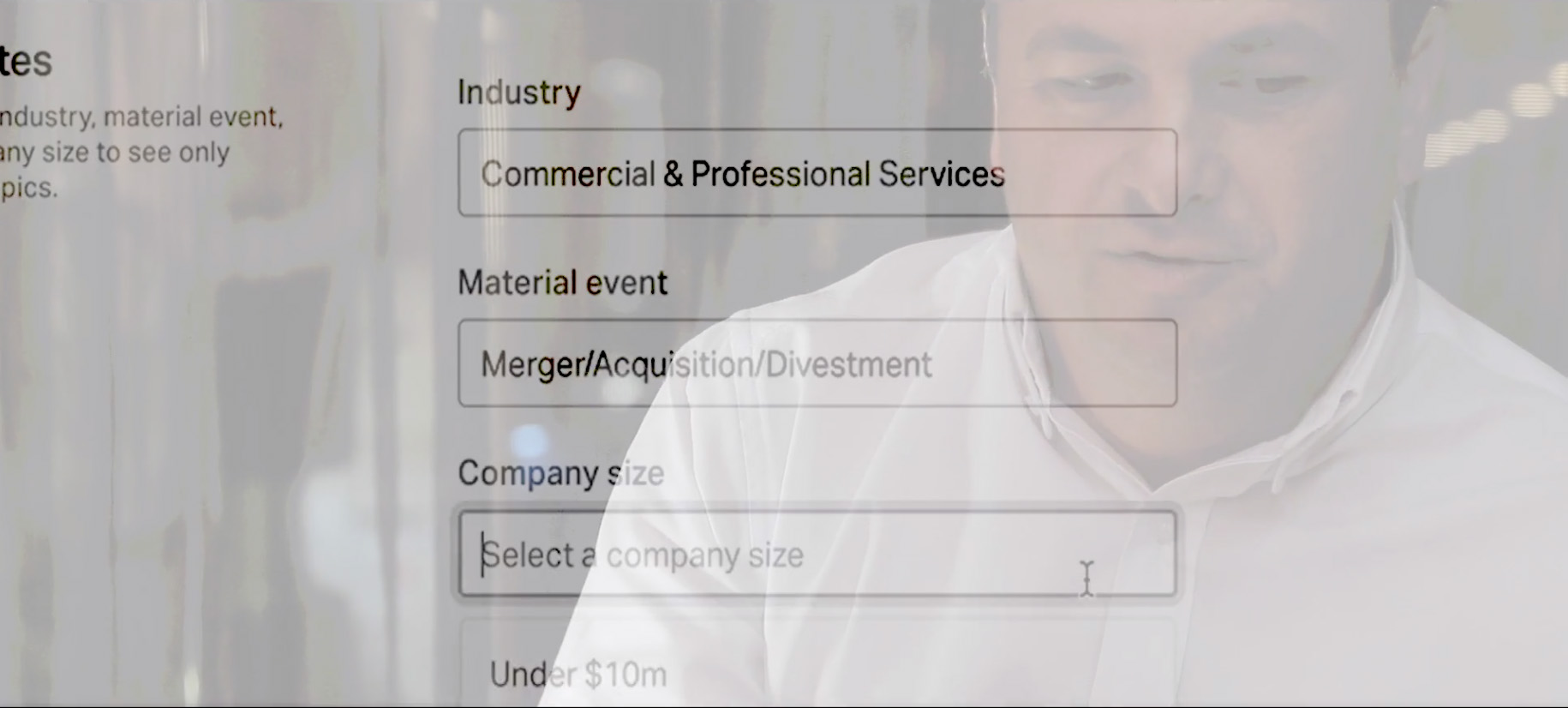

Advisors need to take advantage of a SaaS solution for the always-on management, collaboration, and integration of information for material events. At no cost to advisors, the Ansarada platform enables the facilitation of deal preparation and execution processes much more efficiently – and not just for transactional deals, but for any business outcome across your client’s business lifecycle, from M&A to audits and compliance.

What organizations aren’t doing enough is leveraging SaaS to integrate all their critical business information from disparate sources across their entire organization to unlock value in the form of critical insights and readiness.

Leading dealmakers are already using SaaS to generate confidence and certainty for their clients as they navigate complex events and turbulent markets.

Transparent SaaS pricing that scales month-to-month offers flexibility and efficiency for events of any size – from M&A and capital raises to simple audits and company reporting.

Using a capital raise as an example: Every business will experience multiple funding rounds in its lifecycle, with each raise typically being just enough to get to the next major milestone. They happen every 12 months on average, but with some entrepreneurs pushing it to as short as 6 months, according to Forbes.

Keeping your client’s critical information housed in the platform and structured based on best practice from 35,000+ transactions (instead of a single use data room) is incredibly valuable when new investors show interest. It enables you to quickly put the same set of information to work on the next funding round - without repeating any manual steps. We’ve already seen dealmakers cut 4-5 days a week off their deal timetable.

A flexible per-user pricing model empowers advisors to limit costs while offering clients exactly what they need for their transaction. It’s the move from a one-size-fits-all approach to a bespoke solution, while they maintain the value that comes from digitizing their data and organizational structure and automating key processes to reach outcomes faster.

Help them achieve a state of always-on readiness for every event in their lifecycle, with all their critical information housed and synced in the platform. So long as they’re subscribed, business will always be in optimal shape and they’ll get the most value out of their data.

The Ansarada platform maintains your client’s critical documentation in a single place - synced, managed and accessible in real-time. API integrations can automatically pull in files from disparate sources and enable them to talk to each other, sharing data and unlocking immense value in the form of critical insights and foresight. Get a clear picture of multiple data sources in a single view, accessible and ready to put to work on an opportunity in seconds. Imagine telling your client, with complete confidence, that they are ready for an IPO?

While this legacy approach might have been effective when businesses operated and technology adopted at a much slower pace, it no longer has a place in an age where a subscription model can offer much greater flexibility and value.

- How much value is lost from every individual deal being prepared for and executed like it is the first – and the last?

- How many hours and resources are wasted when existing due diligence information and frameworks aren’t re-used?

- How much value is lost when data from multiple sources isn’t integrated and therefore can’t be leveraged for strategic decision making?

SaaS is the solution

Software-as-a-Service (SaaS) has already demonstrated its potential to offer companies of all sizes flexibility and savings, having shifted business models and operations dramatically over the last decade.Research from IDC shows SaaS delivery will significantly outpace traditional software product delivery, growing nearly five times faster than the traditional software market. This year, the cloud software model will account for $1 of every $4.59 spent on software.

Advisors need to take advantage of a SaaS solution for the always-on management, collaboration, and integration of information for material events. At no cost to advisors, the Ansarada platform enables the facilitation of deal preparation and execution processes much more efficiently – and not just for transactional deals, but for any business outcome across your client’s business lifecycle, from M&A to audits and compliance.

Companies are already paying for SaaS solutions

Companies are always using SaaS solutions for everything from file sharing and online storage, to payroll and HR, to marketing and sales. IDC cites data security, along with brand trust, as among the most critical attributes that SaaS buyers seek.What organizations aren’t doing enough is leveraging SaaS to integrate all their critical business information from disparate sources across their entire organization to unlock value in the form of critical insights and readiness.

Leading dealmakers are already using SaaS to generate confidence and certainty for their clients as they navigate complex events and turbulent markets.

Advisors must shift to an always-on approach

Rather than buying a data room outright for a fixed term - with strict limitations and high-costs to upgrade or extend – advisors need to leverage a subscription model that will give their clients an always-on solution for achieving any critical outcome.Transparent SaaS pricing that scales month-to-month offers flexibility and efficiency for events of any size – from M&A and capital raises to simple audits and company reporting.

From one-off deal preparation to always-on readiness

The Ansarada platform maintains your client’s critical documentation in a single place - synced, managed and accessible in real-time. Automated Pathways offer clear frameworks to put this information to work in seconds.Using a capital raise as an example: Every business will experience multiple funding rounds in its lifecycle, with each raise typically being just enough to get to the next major milestone. They happen every 12 months on average, but with some entrepreneurs pushing it to as short as 6 months, according to Forbes.

Keeping your client’s critical information housed in the platform and structured based on best practice from 35,000+ transactions (instead of a single use data room) is incredibly valuable when new investors show interest. It enables you to quickly put the same set of information to work on the next funding round - without repeating any manual steps. We’ve already seen dealmakers cut 4-5 days a week off their deal timetable.

From limiting contracts to flexible subscription pricing

The same goes for any other material event – whether it’s an audit or an M&A deal, your client can adjust their plan to scale so they can maintain value without the commitment.A flexible per-user pricing model empowers advisors to limit costs while offering clients exactly what they need for their transaction. It’s the move from a one-size-fits-all approach to a bespoke solution, while they maintain the value that comes from digitizing their data and organizational structure and automating key processes to reach outcomes faster.

From a single transaction to ongoing business and client loyalty

SaaS promotes long-term client loyalty by adding value to their business from day one. A successful transaction is good news, but consistently great outcomes are the result of ongoing engagement with your client’s business.Help them achieve a state of always-on readiness for every event in their lifecycle, with all their critical information housed and synced in the platform. So long as they’re subscribed, business will always be in optimal shape and they’ll get the most value out of their data.

From guesswork to insights on-demand

The key benefit of enabling an always-on solution is ultimately, data. The amount of information that is lost when each deal is treated individually is a huge disadvantage – not to mention the huge amount of additional work that puts an unnecessary tax on you and your clients.The Ansarada platform maintains your client’s critical documentation in a single place - synced, managed and accessible in real-time. API integrations can automatically pull in files from disparate sources and enable them to talk to each other, sharing data and unlocking immense value in the form of critical insights and foresight. Get a clear picture of multiple data sources in a single view, accessible and ready to put to work on an opportunity in seconds. Imagine telling your client, with complete confidence, that they are ready for an IPO?

More benefits of an always-on approach for advisors

- Offer a more complete solution to your clients

- Stay front of mind when the client wants to pursue further acquisitions or other outcomes

- Know where your client’s business stands before you start due diligence – never start from scratch

- Avoid the risk of surprise risks or gaps being uncovered by a third party or derailing the deal

- Cut hours of manual work collecting and maintaining version control from all sources - software, systems, emails - and limit the potential for human error

- Eliminate hours of Q&A and collaborative back-and-forth, including time-consuming explanations and verification

- Integrate all disparate data sources into a single platform for clear visibility and accountability

- Quickly get the information you need so you’re ready to act with confidence at a moment’s notice.

- Free up resources to focus on higher-value work and execution of the broader strategy

Get the Ansarada advantage

Ask us how you can turn your approach from transactional to always on

Request a demo of the Ansarada platform