Process is what drives due diligence progress

Bring order to the chaos of due diligence processes with Ansarada Deals™ and get the outcome you want, every time.

Purpose-built tools help you structure your information to avoid unnecessary time, cost and risk

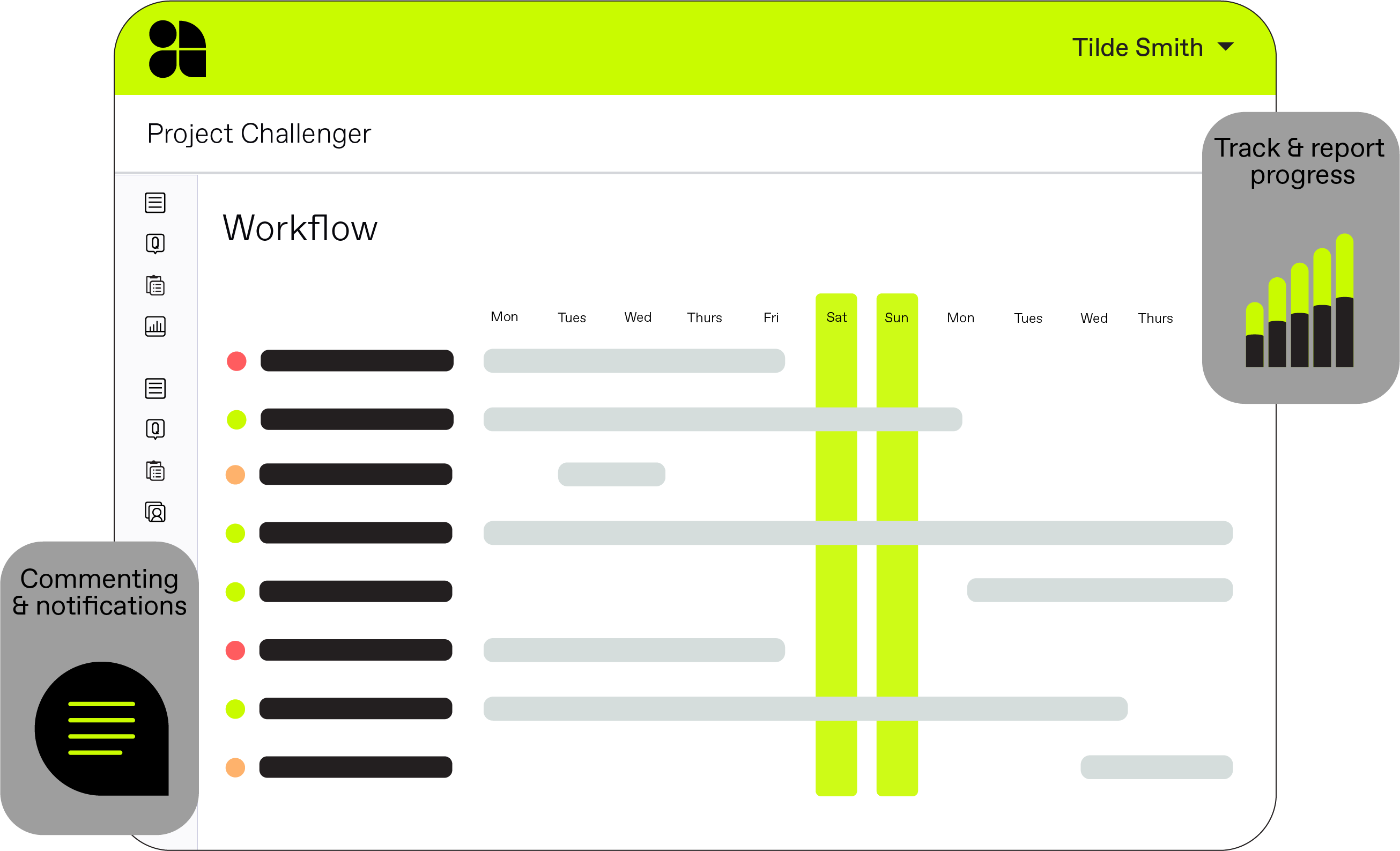

Use Deal Workflow™ to track milestones, people, and progress in a simple dashboard

Digitize your due diligence checklist to automate your workflow and close the deal faster

Protect your deal and your reputation in the world’s most secure Virtual Data Room

First impressions count

One centralized platform

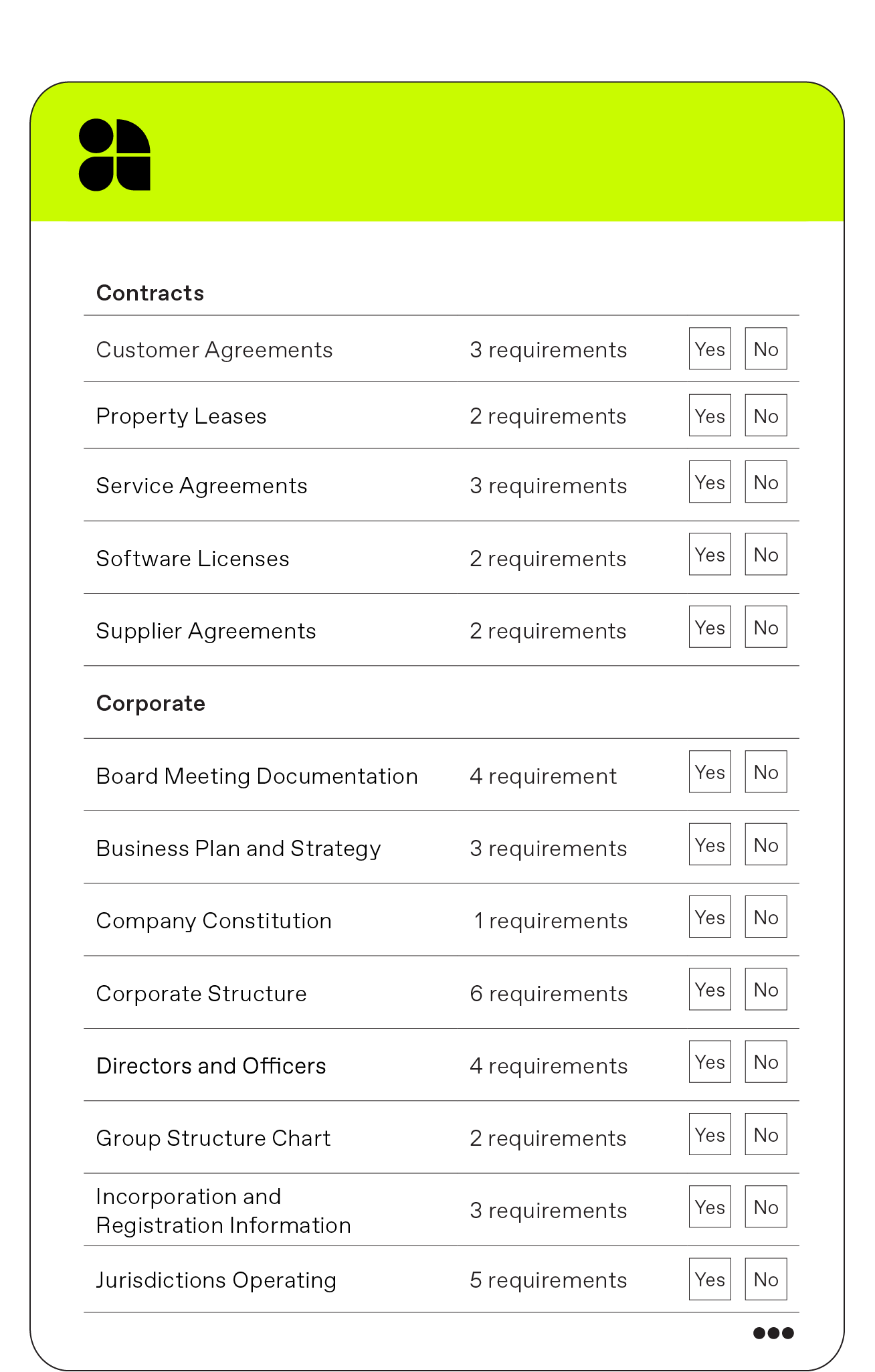

Stay in control with purpose-built digitized workflows that cover all your key business areas

Assess business in minutes

Load your documents into digitized workflow templates to surface risks early on

Confidence & control

Satisfy risk, compliance and disclosure requirements with ease. Reports capture every action

Project management workflow

Digitize your due diligence checklist for the most efficient project management of processes and teams

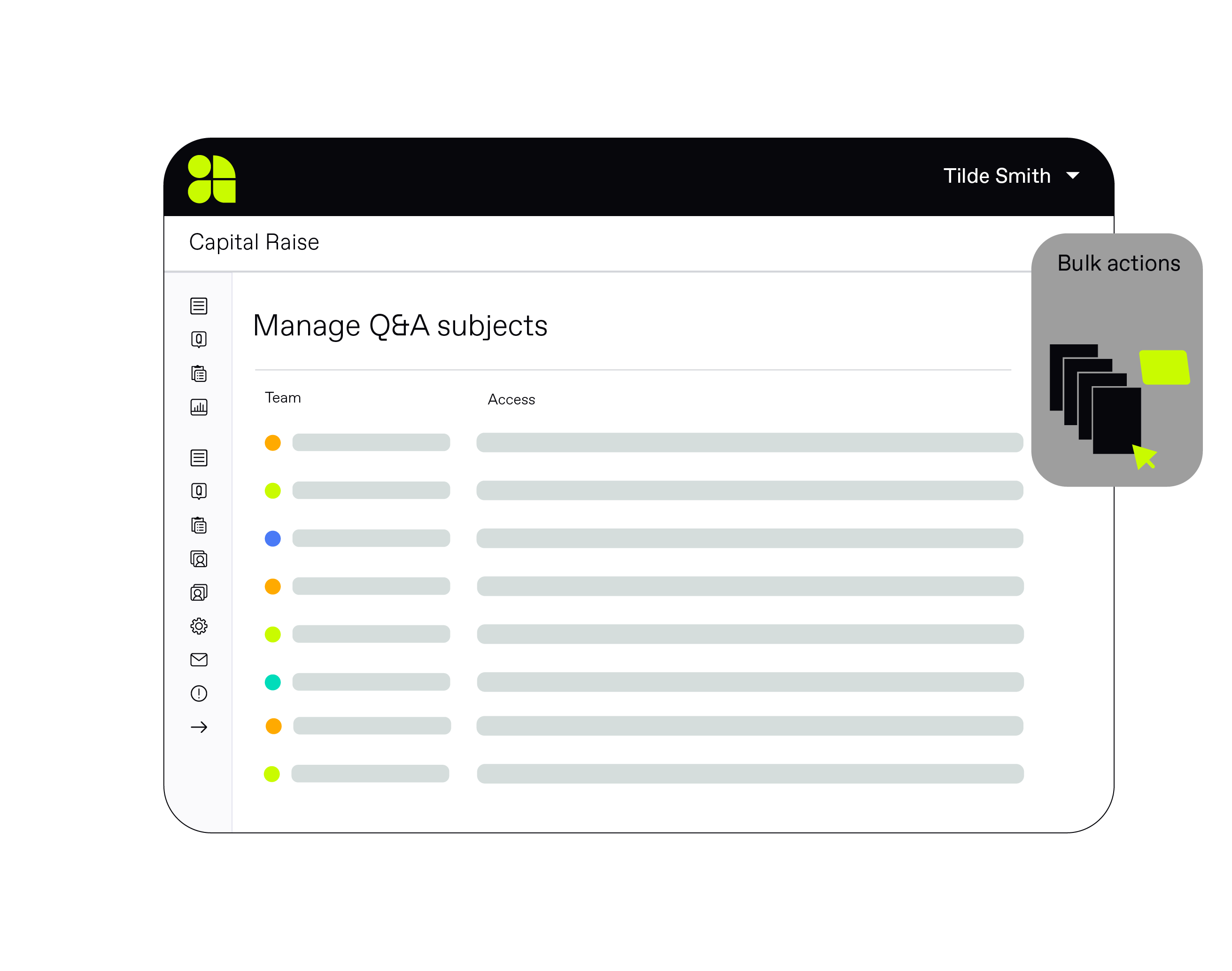

Streamline processes

Speed and visibility with Q&A facility, review and approval workflows, commenting tools and notifications

Fortune favors the organized

Be confident that your information will hold up to third-party scrutiny.

Get prepared well in advance

Nearly half of all deals fail due to issues surfaced in due diligence. Flag and address all risks and opportunities early, before disclosing your information to third parties in the document index and be confident you’ve got full visibility over the process end to end.

Avoid the due diligence scramble

Empower your team and your advisors for all the dynamics of your outcome with an integrated project management space, in-built workflows, notifications, and collaboration tools. Save hours chasing people for the required information and data and keep momentum moving.

Boost efficiencies with a simplified & structured process

When it’s time to execute your outcome, seamlessly transfer your information into an AI-powered Virtual Data Room for bidders, investors, advisors or other third parties to access securely. Collaborate with due diligence Q&A features that keep Q&A tracked and contained within the room.

The big players trust us for a reason

UBS has trusted Ansarada for 10 years on more than 100 deals of all types, sizes and complexities. Their service, product design and performance provides everything we need to reduce deal risks, extract valuable insights and execute efficiently.Guy Fowler, former Head of Capital Markets & Head of Corporate Advisory, UBS Group

Take control of your due diligence process