How to maximize your valuation in a capital raise through sustainability

Gone are the days when securing capital was solely about profits. Today, sustainability concerns reign supreme in the world of raising. To meet investor demand and attract investment, organizations today need to prove their commitment to sustainability. Here’s three simple steps to maximize your valuation through sustainability.

By AnsaradaMon Jul 24 2023Due diligence and dealmaking, Capital raising, CEO-CFO, Investors, Product know how, Environmental Social and Governance

Investors are already using ESG metrics to screen investments. Businesses seeking to raise capital today are routinely expected to be able to show the strength of their commitment to the principles of ESG and sustainability, and to demonstrate how they are embedded within day-to-day operations.

Corporate responsibility is at the forefront for investors

To get the highest valuation and the largest pool of potential investors, quality sustainability disclosures at the due diligence stage are a must-have.“If, in a group of companies in a given sector, there is one lagging behind [on ESG aspects], clearly it will be a challenge for that company to get access to equity and debt. It’s now something that’s core to the analysis of investors and banks,” said Olivier Menard, Head of Green and Sustainable Finance APAC at Natixis.

Companies need to keep in mind the dual meaning of the word sustainable. Not only is ‘sustainability’ related to sustaining the planet and society, but crucially it relates to business self-sufficiency and stability in the long run, with a host of related benefits.

Benefits of being a sustainability-led company

Beyond maximizing their valuation, there are many reasons that businesses can benefit from a sustainability-led strategy.93% of global institutional investors actively consider ESG and sustainability in their investment decisions, with 17% considering it a critical factor.

Morgan Stanley’s Institute for Sustainable Investing 2021 report showed that 79% of all investors and 99% of millennial investors reported interest in sustainable investing. Their research also showed that sustainable funds outperformed traditional funds, and the S&P 500 ESG Index has outperformed the broader S&P 500 for the past decade.

McKinsey’s research has proven that sustainable companies create more long-term value, and that global sustainable investment now tops $30 trillion—up 68 percent from a decade ago. Additionally, research from Bloomberg Intelligence (BI) suggests that global ESG assets could surpass $50 trillion by 2025.

In Pitcher Partners’ Business Radar 2022 report, 50% of mid-market corporate respondents said that ESG initiatives reduced costs, 47% said they improved revenue and growth, and 43% said they increased employee engagement.

As well as increased returns and a clear purpose, sustainable businesses are also associated with higher resilience and decreased volatility. Historically, sustainable funds have bounced back during economic downturns including the 2008 and 2018 market breakdowns.

For these reasons, ESG investments are starting to be viewed by many as a buffer against current market uncertainties. Factors like effective governance, transparent supply chains, and reduced environmental impact can shield companies from ESG-related risks, which have the potential to increase volatility and disruption.

On the flip side, failure to address sustainability issues – or failure to address them early enough – leads to risk. Companies seeking capital need to be prepared for ESG issues to be raised and questioned by investors. Sub-par disclosures on ESG will put companies at risk of losing access to key sources of capital. Not preparing for this line of questioning proactively will put you on the back foot, impacting raise momentum and your credibility.

Use your raise as a catalyst to get your business in order

Given the overwhelming benefits, being required to disclose sustainability information should be viewed as an opportunity, rather than a hurdle.ESG goals are not short-term goals. They require a long-term vision and strategic plan for addressing all these issues in the future. Planning should account for the ongoing maturing of the company along its sustainability journey.

Investors want to see evidence that sustainability issues have been considered, external stakeholders have been consulted, and a plan is in place to act on priority ESG initiatives. They want proof that you have started this journey, and that you will commit to consistently traveling along that path.

Throughout the due diligence process, investors are ultimately judging the level of risk and opportunity in your business. And sustainability plays a major role in your company’s potential for value creation and risk mitigation.

Learn more: Environmental Due Diligence

3 steps to maximize your valuation through a sustainability-centered raise

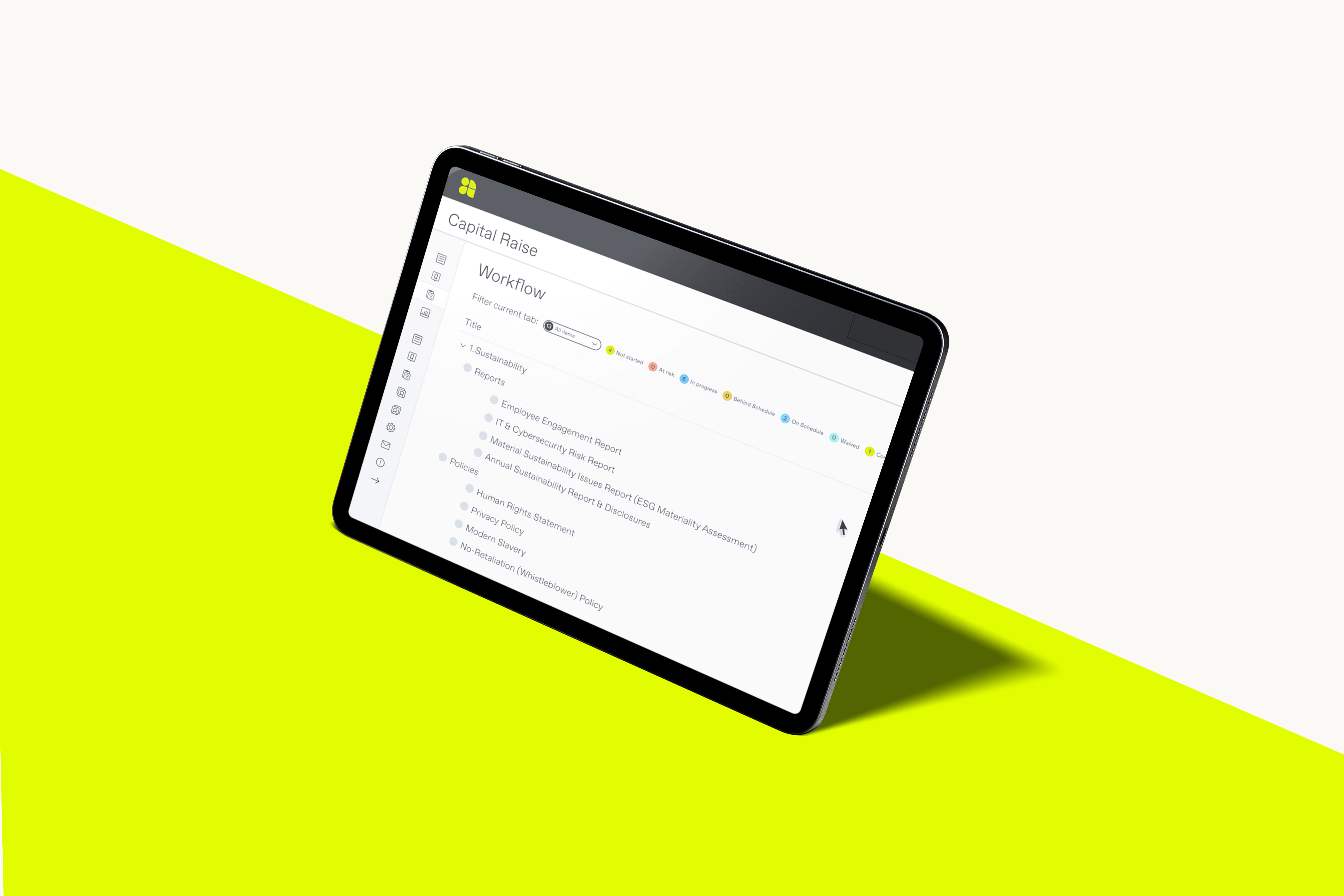

1. Open a free Data Room to use Ansarada’s modern capital raise template

Ansarada’s modern capital raise template allows you to start preparing for your raise for free while benefiting from our suite of advanced data room & deal tools, like workflow project management and secure file sharing.The template, built off the learnings of over 35,000 prior transactions, prepares you for investment with a winning document structure. As soon as you open your free Data Room, you’ll get instant access to the structure, documentation, and investor requirements in an easy-to-follow digitized template. This includes essential sustainability information that investors will want you to disclose.

Start your raise right with Ansarada

2. Let us help you fill in sustainability disclosure gaps

Every company will have their own sustainability journey – there is no one-size-fits-all approach to ESG. To realize value, business leaders need to address those issues that are most material to them, based on their business and their industry.A materiality assessment is the best way to help you narrow down your ESG priorities, build trust with stakeholders, and formulate a clear path forward on ESG objectives. It’s a valuable process for ensuring that your organization understands its key impacts, risks and opportunities and is in touch with the issues that matter most to its stakeholders.

Due diligence topics are broad and often fragmented. Having the data room structure tailored to Materiality Assessment outputs before presenting it to investors puts you on the front foot for ESG due diligence and establishes the foundations for your long-term sustainability journey moving forward.

3. Invite your potential investors

When your template is populated and organized, transfer seamlessly into Ansarada's AI-powered Data Room and invite your investors.Now, in the due diligence phase, you will have addressed sustainability gaps and opportunities, outlined your critical ESG priorities, and be ready to respond to deal Q&A - where ESG will be front of mind.