M&A: Tech deals second-highest on record

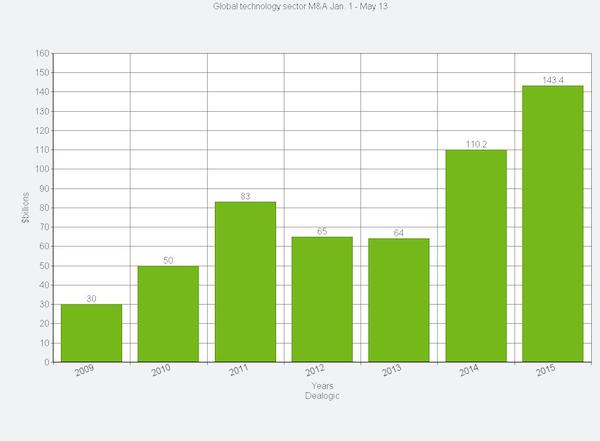

Global technology mergers and acquisitions in the year to date are the second highest on record at $143.4 billion, according to Dealogic.

By ansaradaMon May 18 2015Mergers and acquisitions, Industry news and trends

The largest technology M&A transaction so far this year is NXP Semiconductor’s $16.7 billion acquisition of Freescale Semiconductor.

Last week’s announcement that Verizon will buy AOL for $4.3 billion is the fourth-largest global technology deal so far in 2015.

Goldman Sachs, among the investment banks, leads the global technology mergers and acquisition league table rankings having advised on $26.8 billion worth of deals.

Credit Suisse and Morgan Stanley have advised on $24.1 billion and $24 billion worth of M&A deals in the sector respectively.

The following is a table of global technology M&A deals between January 1 and May 13 since 2009, according to Dealogic data.

Source: Dealogic

Last week’s announcement that Verizon will buy AOL for $4.3 billion is the fourth-largest global technology deal so far in 2015.

Goldman Sachs, among the investment banks, leads the global technology mergers and acquisition league table rankings having advised on $26.8 billion worth of deals.

Credit Suisse and Morgan Stanley have advised on $24.1 billion and $24 billion worth of M&A deals in the sector respectively.

The following is a table of global technology M&A deals between January 1 and May 13 since 2009, according to Dealogic data.

Source: Dealogic

Discover the Ansarada difference

We've helped 400,000 dealmakers achieve high-performance outcomes

Ask us how