Skype acquisition: a raw deal for Microsoft?

The Skype acquisition received criticism — did Microsoft get a good deal in 2011? Here’s what we can learn today.

By AnsaradaThu Feb 20 2025Mergers and acquisitions, Post-deal integration

In 2011, Microsoft acquired Skype for $8.5 billion in cash, its biggest acquisition to date, and will retire the platform in May 2025. The acquisition occurred before the pandemic, which made connecting online integral to businesses and customers.

Now the tech, customer base, and learnings from Skype have propelled the development of Microsoft Teams, which has 320 million active monthly users in early 2025. Skype has served its purpose and will now be sunset, leaving Microsoft’s owned video calling platform as a leading choice for corporations connecting remotely.

Paying ten times the annual revenue for a company that had not been profitable since it began in 2003, many questioned whether this was a good deal for Microsoft. However, Microsoft had done something similar before, acquiring Hotmail and replacing it with Outlook some years later.

So was Skype a raw deal for Microsoft? This acquisition and post-acquisition integration provides valuable lessons for driving value from mergers and acquisitions in tech.

Key Takeaways

A closer look at the opportunities, risks and challenges Microsoft faced reveals whether Skype was ultimately worth the high purchase price.

Skype also carried around $686 million in debt, with annual revenue of $860 million and operating profits of $264 million. In this example, carrying a small amount of debt and investing in product development paid off when the buyer looked beyond the debt to see the technology’s long-term potential.

Within seven months of the purchase, Skype’s user base jumped by 26% to almost a quarter of a billion, demonstrating the market demand for the VoIP service.

In the case of Skype, the web services had a large number of users but none of these were locked in. Microsoft would need to demonstrate value to keep the customers on the platform.

After the acquisition, Skype’s functionality was integrated into Microsoft technology, including Xbox and Windows devices. Skype users could connect with Lync, Outlook, Xbox Live, and other communities in the ecosystem. One-to-one video chat through Microsoft products became easier and callers could be connected through the phone system.

In March 2017, Microsoft Teams was launched, combining group calls, audio and video conferencing, online meetings and chat functions in a single tool. With a free version of Teams available for non-Office users, Teams became the most widely used program of its kind by the end of 2018.

Teams replaced Skype for Business, which was retired in July 2021.

This transformation mirrors Microsoft’s purchase of Hotmail in 1997, which it replaced with Outlook in 2003. Outlook was similarly successful, within six months the platform had 60 million customers. In 2015, the mobile version was added, with the same features as the desktop application.

Now the tech, customer base, and learnings from Skype have propelled the development of Microsoft Teams, which has 320 million active monthly users in early 2025. Skype has served its purpose and will now be sunset, leaving Microsoft’s owned video calling platform as a leading choice for corporations connecting remotely.

Paying ten times the annual revenue for a company that had not been profitable since it began in 2003, many questioned whether this was a good deal for Microsoft. However, Microsoft had done something similar before, acquiring Hotmail and replacing it with Outlook some years later.

So was Skype a raw deal for Microsoft? This acquisition and post-acquisition integration provides valuable lessons for driving value from mergers and acquisitions in tech.

Key Takeaways

- Bids from Facebook and Google drove Microsoft’s Skype purchase price up to $8.5 billion.

- Skype’s user base grew by 26% to 250,000,000 within 7 months of acquisition, showing clear demand for the VoIP service.

- By 2012, Skype was the fourth most downloaded free app on IOS and Android devices.

- Microsoft and Windows gained market traction, entering the cloud telephony market and enhancing real-time communication across other products.

- A successful post-purchase integration strategy kept Microsoft competitive as one of the big five tech companies, alongside Apple, Meta, Alphabet, and Amazon.

- Microsoft would retire Skype as a stand-alone service in 2025.

Microsoft and Skype — 10 key lessons for tech M&A

The 2011 purchase of Skype under CEO Steve Balmer deepened Microsoft’s focus on real-time video and voice communication and provided new market opportunities to serve Skype’s 160 million active users, a number which would fall to 23 million by 2020 as the platform failed to keep up with smartphone technology and provide a simple user experience.A closer look at the opportunities, risks and challenges Microsoft faced reveals whether Skype was ultimately worth the high purchase price.

Strategic value can justify a high purchase price

Microsoft paid $8.5 billion for Skype, around twice the company’s most recent valuation. At the time, Skype was a privately owned company, with rumours that it was preparing for an IPO worth around $3 billion (the price paid by eBay in 2005).Skype also carried around $686 million in debt, with annual revenue of $860 million and operating profits of $264 million. In this example, carrying a small amount of debt and investing in product development paid off when the buyer looked beyond the debt to see the technology’s long-term potential.

Within seven months of the purchase, Skype’s user base jumped by 26% to almost a quarter of a billion, demonstrating the market demand for the VoIP service.

Integration is key to realising potential synergy

A post-acquisition integration walks a tightrope between allowing the independence of the new business unit and integrating the technology throughout other products and operations.In the case of Skype, the web services had a large number of users but none of these were locked in. Microsoft would need to demonstrate value to keep the customers on the platform.

After the acquisition, Skype’s functionality was integrated into Microsoft technology, including Xbox and Windows devices. Skype users could connect with Lync, Outlook, Xbox Live, and other communities in the ecosystem. One-to-one video chat through Microsoft products became easier and callers could be connected through the phone system.

In March 2017, Microsoft Teams was launched, combining group calls, audio and video conferencing, online meetings and chat functions in a single tool. With a free version of Teams available for non-Office users, Teams became the most widely used program of its kind by the end of 2018.

Teams replaced Skype for Business, which was retired in July 2021.

This transformation mirrors Microsoft’s purchase of Hotmail in 1997, which it replaced with Outlook in 2003. Outlook was similarly successful, within six months the platform had 60 million customers. In 2015, the mobile version was added, with the same features as the desktop application.

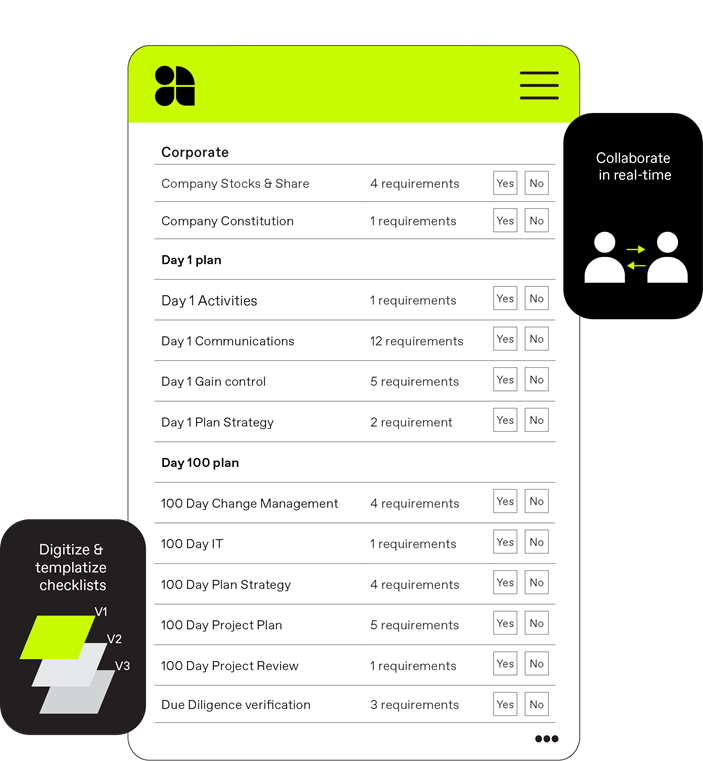

Plan to realise value with a structured post-merger integration checklist

Sealing the deal is only the first step. Reduce the risk of post-deal failure by using a structured post-merger integration checklist.

An engaged audience or user base has value

Microsoft was able to serve Skype’s more than 160 million users with owned technologies like Lync, Outlook, Xbox Live, and other communities. The acquisition allowed Microsoft to connect callers more easily through the phone system and provide one-to-one video chat.Major technology transitions carry risk

The challenge with any major technology acquisition is to retain what makes the technology great while realising value through integration with other products.Skype was founded in 2003 and acquired by eBay in September 2005 for $2.6 billion. Following the acquisition, the audience grew rapidly, but synergies with eBay did not materialize—eBay sellers and customers preferred the anonymity of direct messaging and email to a face-to-face video call to navigate a transaction. The company was then sold to the investment group led by Silver Lake for $3 billion.

Cross-platform support is essential

Once Skype became part of the Microsoft suite, the service was maintained for Android, iOS and other platforms to avoid alienating the engaged user base. In 2012 Skype was the fourth most downloaded free app of all time for the iPhone and iPad.Freemium models can drive up value

With 170 million regular users in 2011, only 8.8 million were paying customers. Offering video and Skype-to-Skype calls for free enabled the company to build a global customer base. This engaged user base was appealing to Microsoft, with post-acquisition plans to monetise the audience and integrate the technology into other products.Acquisitions provide quick entry to new markets

Windows systems were falling behind Apple, which had FaceTime, in 2011. Acquiring Skype allowed Microsoft and Windows to gain market traction. Entering the cloud telephony market and enhancing real-time communication across other products brought benefits.Skype for Business also opened up a new, lucrative market. Enterprises that integrated Skype with private telephone switchboards could use Skype Manager to track, trace and manage how employees used the service.

Following a tight integration path to combine Skype with Microsoft Live, Microsoft Messenger and Lync, eventually leading to Microsoft Teams launch in 2017, Microsoft captured a strong market share in voice and video services for businesses.

Competitive pressure can drive up deal prices

In 2010, Google, Facebook and Microsoft were all racing to acquire Skype. Pitting these tech giants against each other enabled Skype to drive up the price beyond what Microsoft had paid for any acquisition at the time. This competitive tension contributed to the high sale price.Enterprise potential is key in selecting an acquisition

At face value the acquisition of Skype gained Microsoft access to a consumer market for VoIP and video calling — but Microsoft looked beyond this to identify the potential of adding this functionality to existing products and additional market segments including companies. Combining voice and video with instant messaging and email services to create a seamless experience for enterprise customers kept Microsoft competitive.Skilled negotiation and an actionable business exit plan

The investment group led by Silver Lake included Index Ventures, Andreessen Horowitz and the Canadian Pension Plan Investment Board which owned Skype in 2010 negotiated the deal at the perfect moment.After purchasing Skype from eBay in 2009 for $3 billion, they nearly tripled profits in the sale. Market conditions were perfect with multiple potential buyers with deep pockets pitted against one another. A clear business exit strategy that was ready to action allowed the investment group to cash out quickly and profitably.

Planning an exit? Plan to secure maximum value

Secure the best possible outcome using a proven, data-based business exit checklist.

Was Microsoft’s acquisition of Skype worth it?

Yes — with the benefit of hindsight, it’s clear that Microsoft’s acquisition of Skype for almost three times the market value at the time went on to deliver profit for the tech giant.Without an effective post-integration strategy and clear internal goals for integrating Skype technology Microsoft may not have had the success it would realise through Microsoft Teams. Microsoft ultimately stayed competitive as one of the big five tech companies, alongside Apple, Meta, Alphabet and Amazon.

A clear post-merger integration strategy starts at the beginning of the deal

The true value of a targeted acquisition can only be realised through a stable and well-planned integration strategy. Integration can’t be an afterthought — preparation begins at the beginning of the transaction.The best way to ensure integration is part of your M&A strategy is to start preparing at the outset. With Ansarada’s automated post-acquisition integration workflow, it’s easier to standardise the process and ensure information gaps and silos are closed.

Ensure targeted acquisitions drive value

Start planning for a smooth integration with Ansarada’s proven deal workflow.

Try Ansarada’s Deal Platform for free