What’s happening for M&A advisors right now?

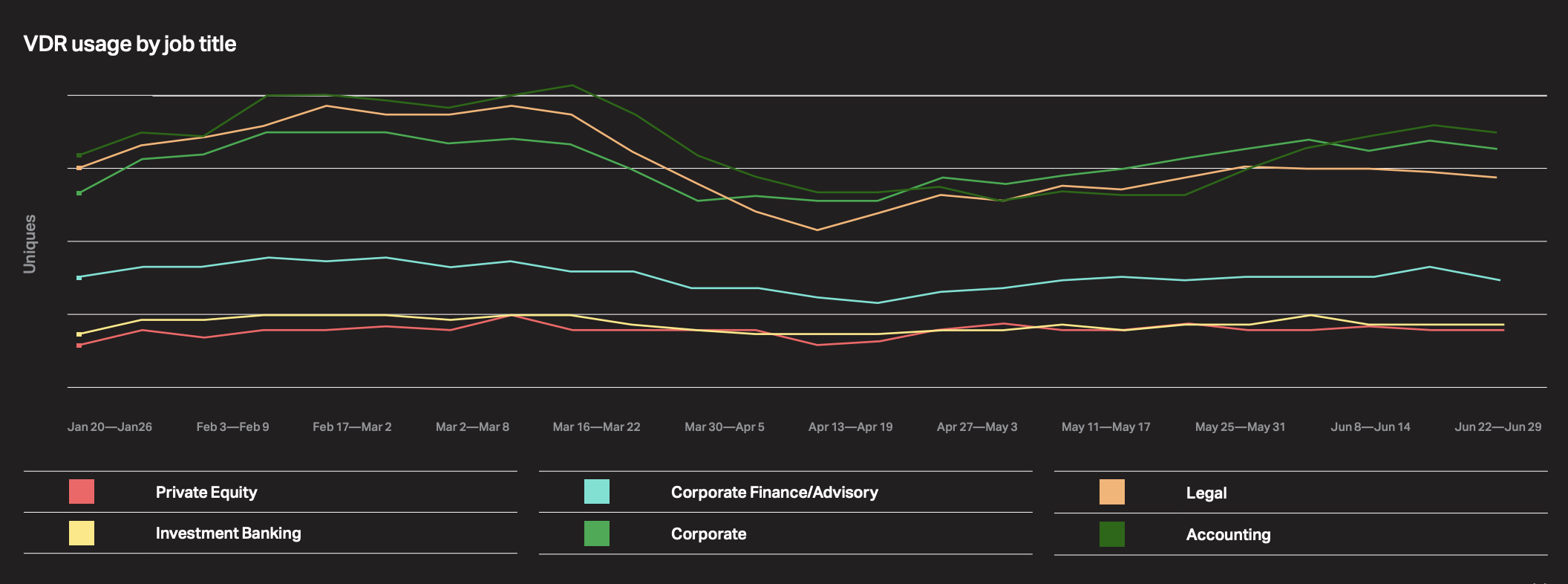

Among the data we collect is a ‘Job Title’ group that allows us to track unique user events within our Virtual Data Rooms.

By AnsaradaWed Sep 23 2020Due diligence and dealmaking, Advisors, Industry news and trends

Filtering our data by job title allows us to clearly see that data room activity among the top three lines – representing Accounting, Legal and Corporate advisors – dropped off significantly in early March (including both buy-side and sell-side activity).

Legal advisors were those hit the hardest, with a 43% decrease in activity from the beginning of March to early April. Accountants were the second most impacted, with a 37% drop in activity.

By early April, this activity has stabilised and is continuing to rise. Since early May, we’ve seen a slow but steady increase of activity from these groups. Corporate advisors were back to 99.7% of their March levels by the first week of June. Accounting and Legal advisors also bounced back to 84% and 77% of their pre-COVID activity by June, respectively.

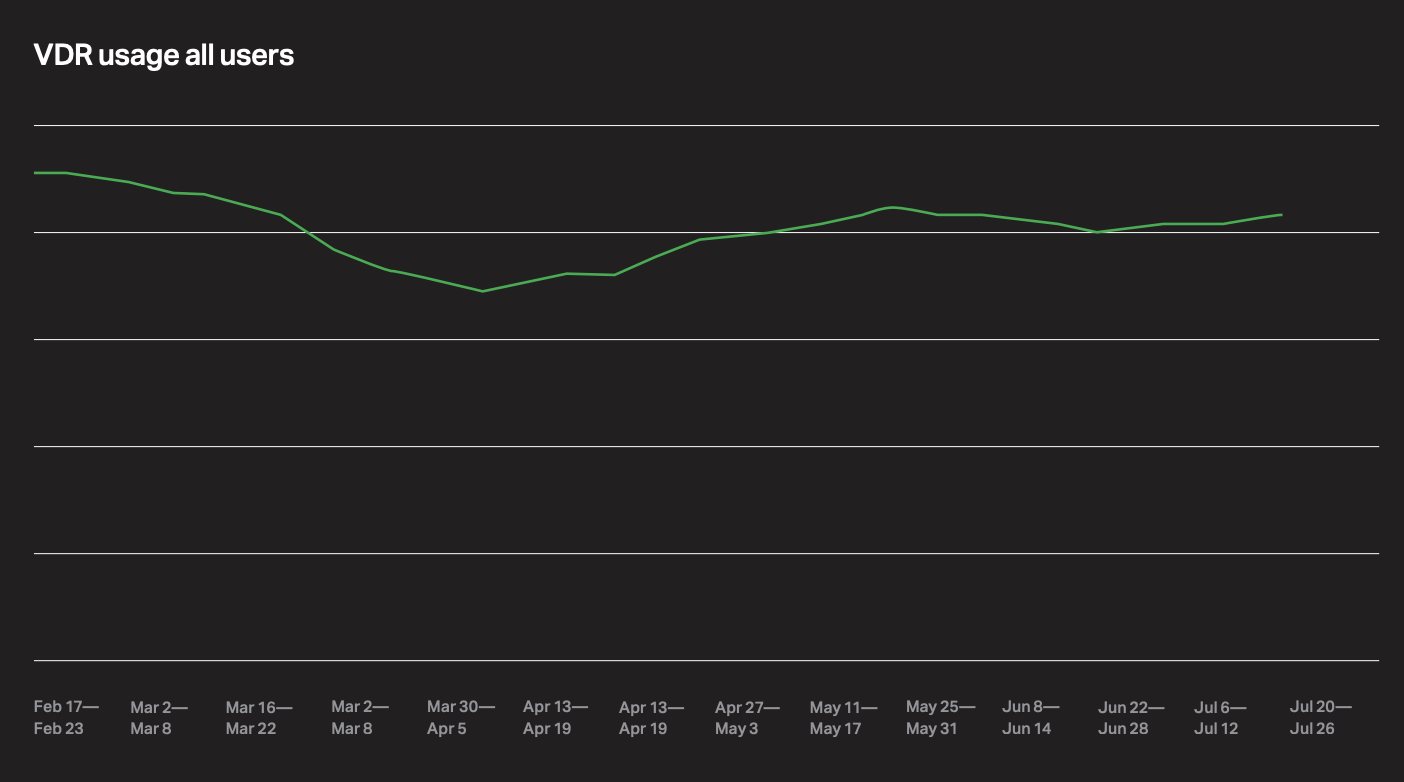

We can even go so far as to correlate the small dip in the beginning of July with the spike in COVID numbers that occurred in Victoria.

Legal advisors were those hit the hardest, with a 43% decrease in activity from the beginning of March to early April. Accountants were the second most impacted, with a 37% drop in activity.

By early April, this activity has stabilised and is continuing to rise. Since early May, we’ve seen a slow but steady increase of activity from these groups. Corporate advisors were back to 99.7% of their March levels by the first week of June. Accounting and Legal advisors also bounced back to 84% and 77% of their pre-COVID activity by June, respectively.

We can even go so far as to correlate the small dip in the beginning of July with the spike in COVID numbers that occurred in Victoria.

The fact that the graph does not dip as much in early July and picks up again the following week (despite COVID numbers continuing to rise) could indicate a growing confidence in the market and the willingness to move forward on transactions, despite ongoing uncertainty.

Advisors hit hardest by COVID but trends are encouraging, data shows

This same dip and rise was mirrored by Investment Banking and Private Equity firms but to a lesser extent. Investment banking saw a 27% decrease in activity between March and April, but was back to 94% of pre-COVID activity by June, while Private Equity dropped 30% in April, and bounced back to 87%.This points to the fact that corporate transactions and the activity from all the people who come together to make them happen is still ongoing.

While the uncertainty may have put a halt on the execution of transactions for the time being, this data shows real-time activity. The groundwork is still being put in, as we can see from what’s happening live.

While it’s clear that lawyers and advisors took the heaviest hit, we’re hopeful that the worst is over. For economic growth, there will always be a need for these transactions to occur, and we’re beginning to see a flicker of optimism amid the uncertainty.

Given this promising baseline, we expect to see momentum growing and more due diligence-based activity ticking back up.

How do you compare to your peers?

Get the detailed statistics in our full Indicators report here.

Download the report