But there are ways to make the process easier. With the right planning and deal preparation tools, your business exit can be streamlined, predictable and fast. So instead of chasing your tail trying to get documentation together, you can focus your efforts on dreaming up your next project (or very long vacation).

Types of exit strategies

There are eight common business exit strategies (listed below), which we’ll look at in detail here: Types of Exit Strategies.

- Merger and acquisition exit strategy (M&A deals)

- Selling your stake to a partner or investor

- Family succession

- Acquihires

- Management and employee buyouts (MBO)

- Initial Public Offering (IPO)

- Liquidation

- Bankruptcy

What’s a good small business exit strategy?

Out of the eight most common exit strategies listed above, a couple stand out as excellent potential options for small business owners looking to exit.The family succession exit (or legacy exit) might be a suitable exit strategy if you want to keep your profitable business ‘in the family’. This is an appealing option for those who want to pass down their company legacy to a child or family member.

Get the pros & cons here: Types of Exit Strategies

On the other hand, a merger or acquisition (M&A) is a strong exit strategy if you’re happy to sell your small business. It’s an attractive option for many startups and entrepreneurs. This business exit entails selling up and handing over the reins to another company.

M&A is one of the strongest exit strategies for business owners, as they can maintain control over price negotiations and set their own terms with buyers.

Planning your business exit

What about planning your business exit in advance?Many small businesses begin as “lifestyle businesses” or passion projects. Then at some point along the way, it’s time for the owner to move on. In these instances, the sale of the company often doesn’t feature in the business plan. Understandably as the owner, you’ve been spending your time running your business, not planning your exit.

But without proper business exit and succession planning, an exit can be a stressful process. Business owners and shareholders can easily feel overwhelmed not knowing where to begin or how things will progress. This can make for a more confusing and less appealing experience for buyers.

Understanding from the get-go how to write a business plan exit strategy can eliminate delays, additional costs and unnecessary frustration down the road.

Learn more about developing your plan here: Business exit planning

Download the Business Exits checklist

The process of selling your business

You’ve invested considerable time, effort and equity into your business and you want to know that you’re going to get maximum return when it’s time to sell.

The most important thing when it comes to selling a business is to be prepared. Get all your documentation in order, secure a business valuation, find the right buyer and then let them do their due diligence - so you can close the deal.

Use our step-by-step process: How to sell a business

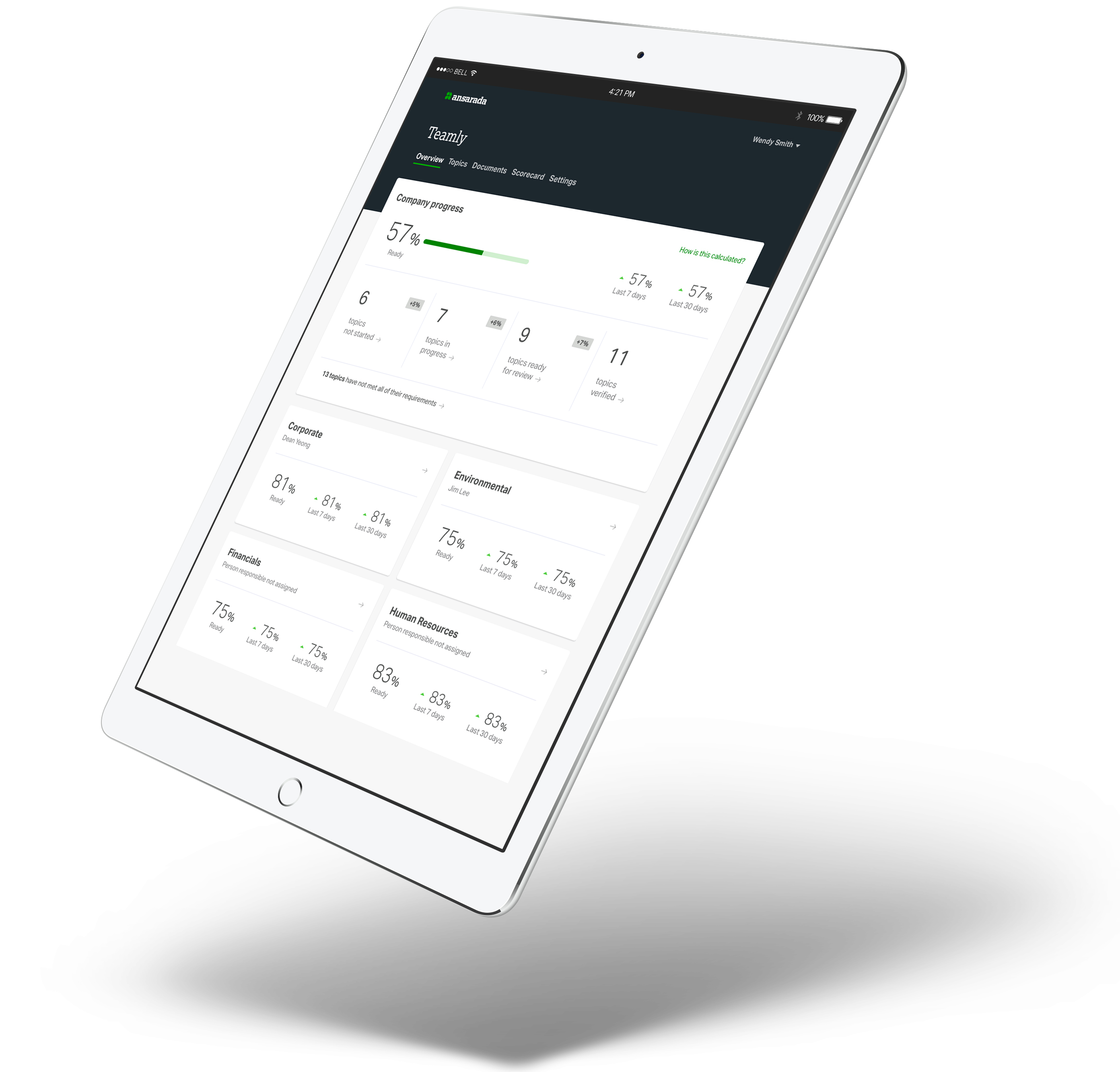

Whether you’re going to sell your business, close the business, float the idea of a management buyout, or offer the business to the public, you can find the right business exit strategy and pathway to success with Ansarada. Learn more: Data Room Software