Get your exit in order with our practical business exits checklist

Business exits, done right. Follow this simple framework to start developing your business exit plan today.

Understand business exits checklists and how to use them

Learn how to structure your information to avoid unnecessary time, cost and risk

Download the free business exits checklist template in Excel format

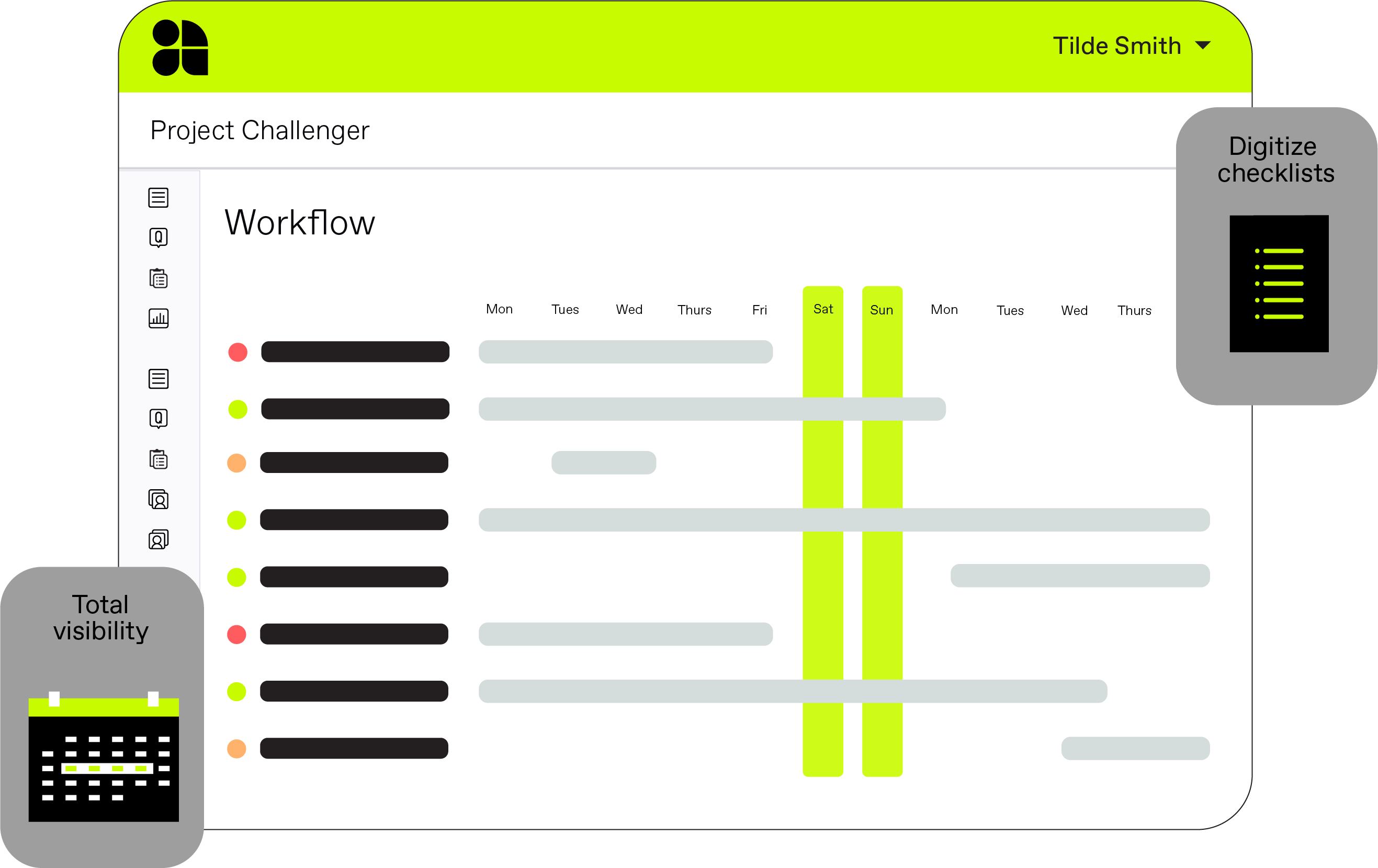

Find out how you can digitize the checklist to automate your sale preparation and due diligence (DD) workflows

Start your exit plan now

Download the free business exits checklist to get started. No risk, all reward.

What is a business exits checklist?

A business exits checklist is a type of due diligence checklist used by those who are preparing to sell or exit their business. It is a checklist of all the documents that need to be collated, verified, and reviewed as part of the due diligence phase of an M&A transaction. It outlines the critical business information that will need to be prepared by business leaders and their financial advisors, then provided to potential acquirers of the company during the sale process.

While exit checklists are often created as Excel spreadsheets or Word documents, modern dealmakers are increasingly turning to deal technology that can digitize these checklists, and facilitate due diligence without the risks associated with legacy tools, such as version control issues and human error.

Learn more:

Heading for the exits

With the strain placed on global markets by the COVID-19 pandemic and the resulting - and ongoing - inflationary & supply chain pressures, many businesses are weighing up their options. One of these options is the potential sale of business.

In a high-stakes macroeconomic environment, it’s critical to start this planning as early as possible. Business owners need a comprehensive exit plan that surfaces issues and addresses those within the business prior to going to market.

Your main priority should be improving the business so that it is attractive to external buyers, allowing you to maximize valuation and sale price. But in order to optimize your business, firstly you need to bring order to the critical information that powers it.

Without a structured process, you risk succumbing to the chaos and hazards associated with poor exit planning when it comes to selling the business.

Learn more: Business exit planning

Risks & chaos associated with exit planning

Loss of business value

There are a number of reasons why a poor business exit can lead to a loss of value both within the transaction and of the business itself.

- Dependence on owner: Unless owners can demonstrate the business will be able to run smoothly without them, the value of the business stands to decrease with their departure. They need to be able to show that the future profitability of their company doesn’t depend on their being there – something they will struggle to do without proper succession planning.

-

Lack of confidence: Without visibility over current business health, owners lack the confidence to go for their optimum sale price, even if their business is worth every penny. This can impact their ability to achieve a reasonable price for their business and drive down business valuations.

-

Buyer has the upper hand: If the seller is disorganized with their business exit planning, they lose control over the sales process and the buyer gets to dictate the terms of the deal. If they don’t have the information structured and ready to show profitability, owners will find themselves at the mercy of the market and not able to proceed on their own terms.

Struggling to find a buyer

In a survey by William Buck, nearly half of all business owners cited ‘being able to find a buyer’ as their top concern regarding their exit. And they are right to be uneasy; a US report by the Exit Planning Institute calculated that only 20-30% of businesses that plan to sell actually find a buyer, despite their readiness to sell.

Being blindsided by the due diligence process

Many business owners are surprised by how intensive due diligence can be, and find themselves underprepared for the scrutiny their business will face when preparing for sale. With the majority of them working more than 40 hours a week already, the amount of additional time, cost and resources that are redirected to the due diligence process can take its toll and negatively impact cash flow.

Following best practices for your company sale

To eliminate risks, business owners need a comprehensive exit plan that surfaces issues and addresses those within the business prior to going to market. The priority should be improving the business so that it is attractive to external buyers. In fact, Forbes says you should consider your exit strategy to be the same as your growth strategy.

Ultimately it comes down to having your information in order; by having critical business information visible, organized, managed and structured in a way that not only improves business health and value in the short term, but that – in the long term – will give buyers full confidence in their decision.

Download the business exits checklist to see exactly what critical documentation you’ll be expected to provide to get your exit in order, and be confident your business is presented in its best light to potential bidders. It’s your practical tool for preparing for a high-value business exit with significantly less risk.

“[Ansarada] is an absolute game-changer, particularly for companies that might need a bit more education around the sale process. Just having them be able to assess where they’re at in their preparedness for an exit; it makes our job a lot easier. We can focus on what we need to do to get a great outcome for the client, with full confidence that they have visibility on where they’re at on that journey, so that when we decide to pull the trigger, we’re ready to hit the ground running.”

- Alex Jordan, Partner, Deloitte

Digitize your business exits checklist

Since 2005, Ansarada has accumulated more than a decade’s experience on over 35,000+ critical business transactions and learned exactly what ‘good’ looks like.

By opening a Data Room today, you can start preparing for your exit for free using Deal Workflow - a project management tool that allows you to digitize all your work streams for complete oversight and control. Simply import your checklist from Excel into Workflow and turn it into a collaborative, real-time source of due diligence progress.

Say no to risky, insecure processes and get your exit in order. Start preparing today for free using your purpose-built exits checklist alongside your Data Room.

Get your exits checklist here

If you don’t want to open up your free Data Room just yet, that’s ok too. Simply fill in the form below to download the free business exits checklist template in Excel.